(i) in sub-rule (1), for the figures “2009”, the figures “2010” shall be substituted (2)They shall come into force on the 1st day of April, 2010.

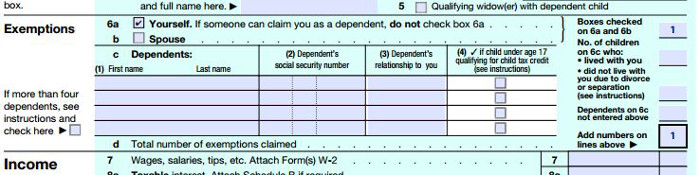

(1) These rules may be called the Income-tax (Third Amendment) Rules, 2010. 943 (E).- In exercise of the powers conferred by section 295 of the Income-tax Act, 1961 (43 of 1961), the Central Board of Direct Taxes hereby makes the following rules further to amend the Income-tax Rules, 1962, namely:-ġ. Where the data of the Return of Income in Forms Saral-II (ITR-1), ITR-2, ITR-3, ITR-4, ITR-5 & ITR-6 transmitted electronically without digital signature.Īcknowledgement for e-Return and non e-Return Income Tax Return in Excel/Word/PDF Formatįor Individuals having Income from Salary / Pension / Income from One House Property (excluding loss brought forward from previous years) / Income from Other Sources (Excluding Winning from Lottery and Income from Race Horses. 2010-11/ Financial Year 2009-2010 in Excel, Word Format Income Tax Return

7) having income from winning from lottery and income from race Horses.ĭownload ITR-1 (Saral II) for A.Y.

0 kommentar(er)

0 kommentar(er)